US Treasury Rate Set to Reassure Fed Focused on Labor Market

(Bloomberg) — U.S. inflation is likely to moderate at the end of the third quarter, encouraging the Federal Reserve as it adjusts its policy to protect the labor market.

Most Read from Bloomberg

The consumer price index appears to have risen 0.1% in September, its smallest gain in three months. Compared to a year earlier, the CPI may have risen by 2.3%, the sixth straight and steady decline since the beginning of 2021. The Bureau of Labor Statistics will issue its report of CPI on Thursday.

The measure excluding food and energy constants, which provides a better view of inflation, is expected to rise 0.2% from the previous month and 3.2% from September 2023.

After the strong employment growth in September reported on Friday, the gradual decline in inflation suggests that policymakers will choose to cut interest rates a bit when they meet again in Nov. 6-7.

Fed Chairman Jerome Powell said that the estimates given by the authorities along with their September rate decision on the reduction of the quarterly rate in the last two meetings of the year.

The CPI and producer price index are used to inform the Fed of its chosen price measure, the consumer price index, which is scheduled for release later this month.

What Bloomberg Economics Says:

“We expect a lower headline CPI in September, albeit a strong core reading. Derived from PCE inflation – the inflation measure chosen by the Fed – core prices are likely to grow at a pace consistent with the target of 2%. Overall, we don’t think the report will do much to boost the FOMC’s confidence that inflation has slowed.”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou and Chris G. Collins, economists. For the full review, click here

Friday’s report on producer prices – a measure of inflationary pressures that businesses face – is also expected to show tamer inflation. On the same day, the University of Michigan releases its October consumer sentiment index. The Fed will also release the minutes of the central bank’s September meeting on Wednesday.

Neel Kashkari, Alberto Musalem, Adriana Kugler, Raphael Bostic and Lorie Logan are among a series of Fed officials speaking next week.

In Canada, officials will release the final jobs report before the Bank of Canada’s next rate decision, which is an important addition to Governor Tiff Macklem, who expects to see a sharp decline in the labor market. The central bank will also publish business surveys and consumer expectations for economic growth and price growth.

Elsewhere, central banks from New Zealand to South Korea may cut rates, France will unveil its budget, and the European Central Bank will publish the minutes of its September meeting.

Click here to see what happened last week, and below is a summary of what’s coming up in the world economy.

Asia

It’s a big week for Asian monetary policy, with two central banks likely to cut rates and one close to doing so.

The Reserve Bank of New Zealand is expected to follow through on its August pivot to cut rates by cutting rates by half a percentage point, to 4.75%, when the board meets on Wednesday, as weak earnings data raises concerns of the labor market.

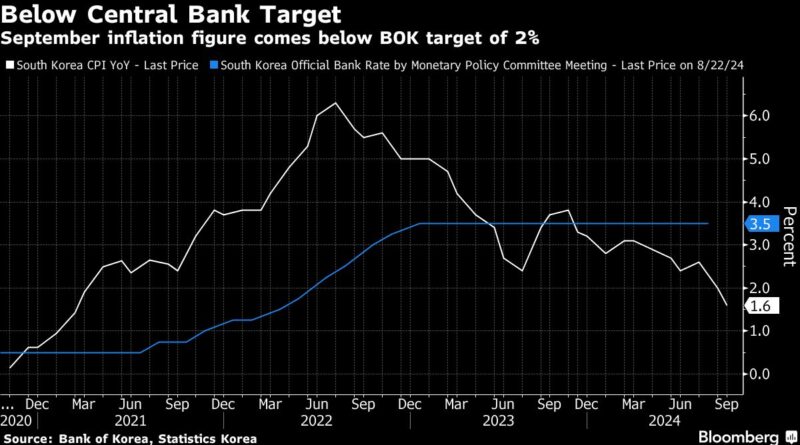

The Bank of Korea is likely to cut its rate by a quarter on Friday after inflation fell to its slowest pace in more than three years, with the decision dependent on whether housing market conditions cool enough .

The Reserve Bank of India appears to have kept its interest rates and reserves steady, with many economists calling for a repo rate cut by the end of the year. And Kazakhstan’s central bank will decide on Friday whether to start its monetary easing campaign.

On Tuesday, the Reserve Bank of Australia released minutes from its September meeting that could shed light on the discussions that led to the hawkish stance, and RBA No. 2, Andrew Hauser, speaks on the same day.

Japan is receiving earnings data and household consumption data, both of which are of interest to the newly installed government ahead of general elections at the end of the month.

Singapore is set to report third-quarter gross domestic product sometime between Thursday and Monday – with consensus estimates looking to accelerate annual growth.

Data released on Sunday showed that Vietnam’s economic growth suddenly accelerated in the last quarter, boosted by manufacturing and imports before a major typhoon in September caused widespread damage and brought it to a halt. farm and factory production.

Consumer price data comes from Thailand and Taiwan, while the Philippines and Taiwan publish trade figures.

Europe, Middle East, Africa

Germany’s manufacturing woes will focus on the release of factory orders on Monday and industrial production on Tuesday, followed by the government’s economic forecast on Wednesday.

Officials are about to give up hope of achieving any increase at all this year, according to people familiar with the matter. Sueddeutsche Zeitung reported over the weekend that Berlin now expects a 0.2% contraction for 2024.

In France, Prime Minister Michel Barnier’s government is set to present its 2025 budget bill on Thursday, at a time when the country is struggling to reduce its deficit. Fitch Ratings has scheduled a possible release of the country’s rating after the market closes on Friday.

For the European Central Bank, Wednesday is the last day for officials to publicly comment on monetary policy before a blackout period begins ahead of the Oct. 17, where a decrease in rate appears to be a near certainty.

Chief economist Philip Lane, Bundesbank President Joachim Nagel, and Bank of France Governor Francois Villeroy de Galhau are among those scheduled to appear. The report of the previous meeting will be published on Thursday, giving possible details about the upcoming sentence.

Meanwhile, in the UK, after the words of the Governor of the Bank of England Andrew Bailey that opened the possibility of more drastic cuts, the GDP data on Friday will point to the health of the economy in August.

Two Riksbank officials are scheduled to speak after Sweden’s central bank delivered its third rate cut in September. Sweden’s monthly growth report will be published on Thursday.

Heading south, Egyptian officials are hoping inflation eased again in September after rising slightly last month. The final figure was 26%, slightly below the central bank’s base rate of 27.25%.

Three central bank decisions are planned around this area:

-

On Tuesday, Kenya’s monetary policy committee is set to cut its key rate for the second straight quarterly meeting, to 12.25%. Inflation is expected to remain below 5% in the near term after falling to a 12-year low in September.

-

On Wednesday, Israeli officials are likely to keep their rate steady at 4.5%, even as peers begin or continue to ease the cycle. The war against Hamas in Gaza and escalating conflicts with Hezbollah and Iran weighed on the shekel, which is close to a two-month low. The country’s credit rating was recently downgraded by Moody’s and S&P.

-

Serbia’s central bank makes its monthly decision on Thursday, possibly continuing its monetary easing after cutting it a quarter point in September.

Latin America

By the end of the week, third-quarter consumer price data for Latin America’s five largest inflation-targeted economies will be in the books.

Lower readings can be expected in Chile, Colombia and Mexico, while Brazil’s economic slowdown and inflation are likely to continue into September. All four central banks are targeting 3% inflation.

In Brazil, despite the central bank’s expectations survey released on Monday, the August retail sales report is likely to show a slight recovery from what it has been reading for 2024.

The minutes of the September 26 Banxico meeting will be important from Mexico. Policymakers were surprisingly muted in their post-decision guidance after the 25-point rate fell to 10.5%.

In Peru, the monthly decrease in September and the low print of 1.78% of the annual rate could light the third straight reduction of the rate of the central bank from the current 5.25.

After a quick crackdown on excessive consumer price inflation, Argentina’s President Javier Milei’s campaign appears to have stalled, with consecutive monthly inflation close to 4%. Economists surveyed by the central bank see a moderate slowdown going forward under the current policy mix.

–With help from Robert Jameson, Laura Dhillon Kane, Piotr Skolimowski, Monique Vanek and Paul Wallace.

(Updates with Germany in the EMEA segment)

Best Reads from Bloomberg Businessweek

©2024 Bloomberg LP

#Treasury #Rate #Set #Reassure #Fed #Focused #Labor #Market