Mortgage Rates Explode, 2-Year and 10-Year Treasuries Raise Confidence, Monster Rate-Cut Hopes Ended, Inflation Fears Continue: The Yield Curve Before and After the Cut

The yield curve continued towards the un-inversion, but not in the way that was hoped.

By Wolf Richter for WOLF STREET.

The asset yield curve was not swayed by another major move on Friday: The three-month yield has changed in the same direction for the past 11 trading days after falling after that the monster’s rate is reduced. But long-term yields rose, starting with one-year yields, on expectations of a rate cut, and deflationary fears returned. This relatively stable position at the short end and the increase in yields kept it from moving another step, but not in the way that people had hoped.

People – especially the real estate industry – were hoping that yields would not change amid a series of rate cuts that would lower short-term yields rapidly, and that long-term yields will follow but slowly, so that yields will drop. would be lower than it was before the rate cut, but with short-term, ultra-low and long-term yields relatively low, and interest rates the house is down again.

But long-term yields have never been fully priced into inflation before, and 10-year yields are still below the Fed’s policy rate; and then they began to fall in November of last year on expectations of more rate cuts – fueled by the labor market tailwind in July and August that has now turned out to be a false alarm – and the price It is much lower in the future than in the present. back to the question.

So when the rate cut started, long-term yields moved in the opposite direction: They jumped amid rising inflation fears, and mortgage rates rose.

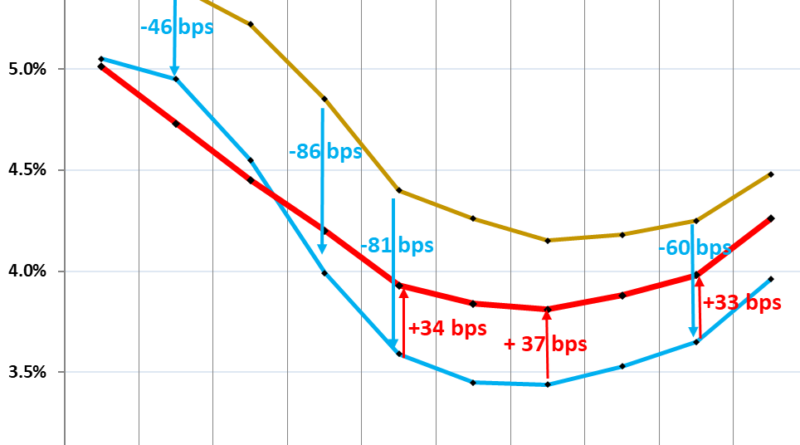

The chart shows “credit yields,” with Treasury yields across the maturity spectrum, from one month to 30 years, for three key dates:

- Gold: July 23, before labor market data goes into a tailpin.

- Blue: September 17, the day before the mega rate cut.

- Red: 4 October, after the job report.

When short-term yields remained flat over the past few days while long-term yields rose, the yield curve did not change – it became flat. Eventually, the yield curve will enter its normal position where short-term yields are lower than long-term yields throughout the yield curve. But it still has a ways to go.

Between July 23 (gold) and September 17 (blue), yields fell eagerly in anticipation of more rate cuts from the Fed – thus, prices are lower in the future (blue numbers and down arrows in the chart above):

- 3-month: -46 basis points

- 1-year: -86 basis points

- 2-year: -81 basis points

- 3-year: -81 basis points

- 5-year: -71 basis points

- 10 years: -60 basis points

- Age 30: -52 basis points

From September 17 (blue) to October 4 (red)from the day before the rate cut to Friday 4 October (red numbers and up arrows in the chart above):

- 3-month: -22 basis points

- 1-year: +21 base points

- 2-year: +34 base points

- 3-year: +39 basis point

- 5-years: +37 base points

- 10 years: +33 base points

- Age 30: +11 base points

The yield jumped the most amid dashed rate expectations.

The 1-year yield, which was as low as 3.88% on September 24, is back at 4.20%, after jumping 18 basis points on Friday.

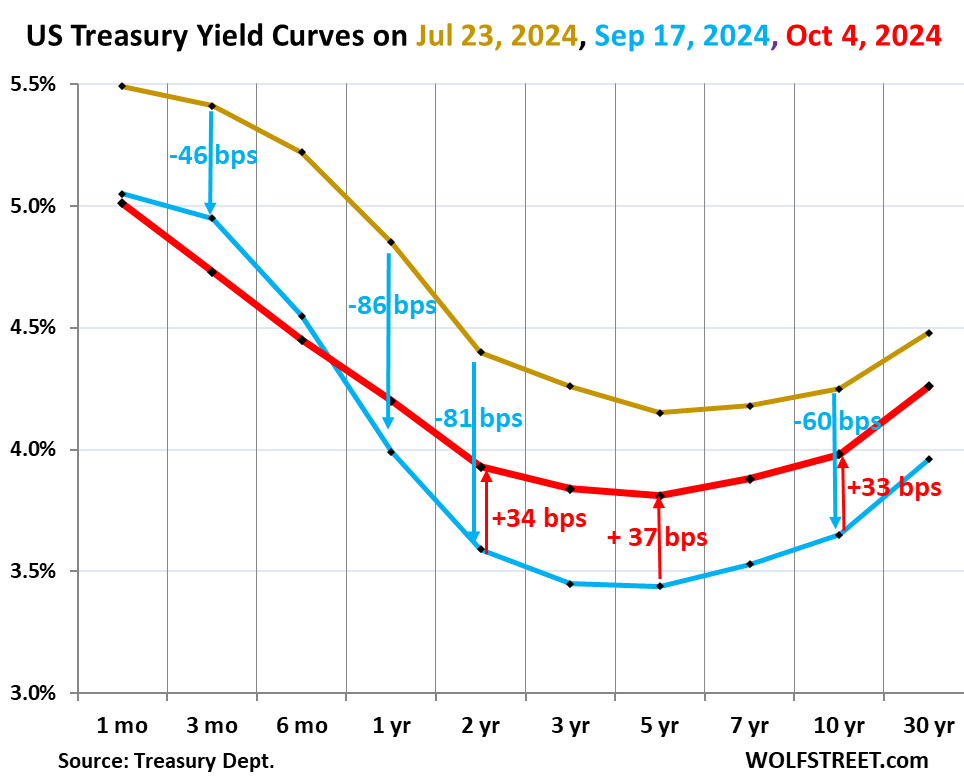

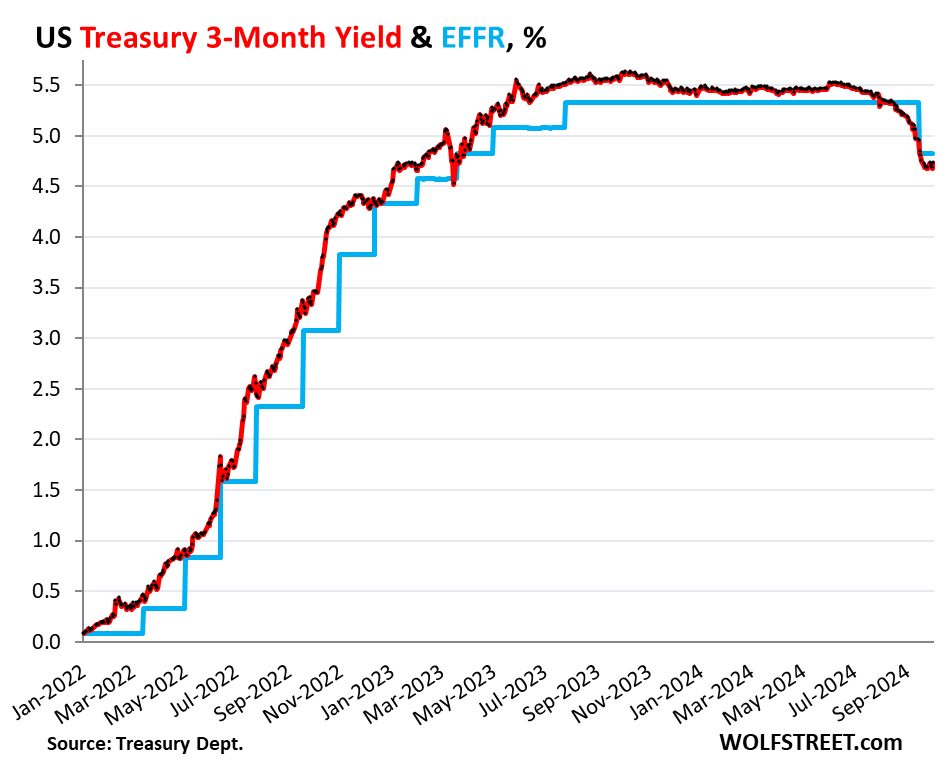

The effective federal funds rate (EFFR), which the Fed expects from its target policy, fell 50 basis points after the Fed announced a 50 basis point rate cut, from 5.33% on Wednesday 18 September, to 4.83% the following day. , and has been there ever since (blue on the charts).

The biggest jump on Friday occurred in 2-year yields, which rose 23 basis points, to 3.93%. In the last two days combined, it has risen by 30 points. This shows that the markets have returned their strong expectations for a rate cut that they entered the September 18th FOMC meeting. Quite a U-turn (EFFR = the effective federal funds rate that the Fed expects in its target policy):

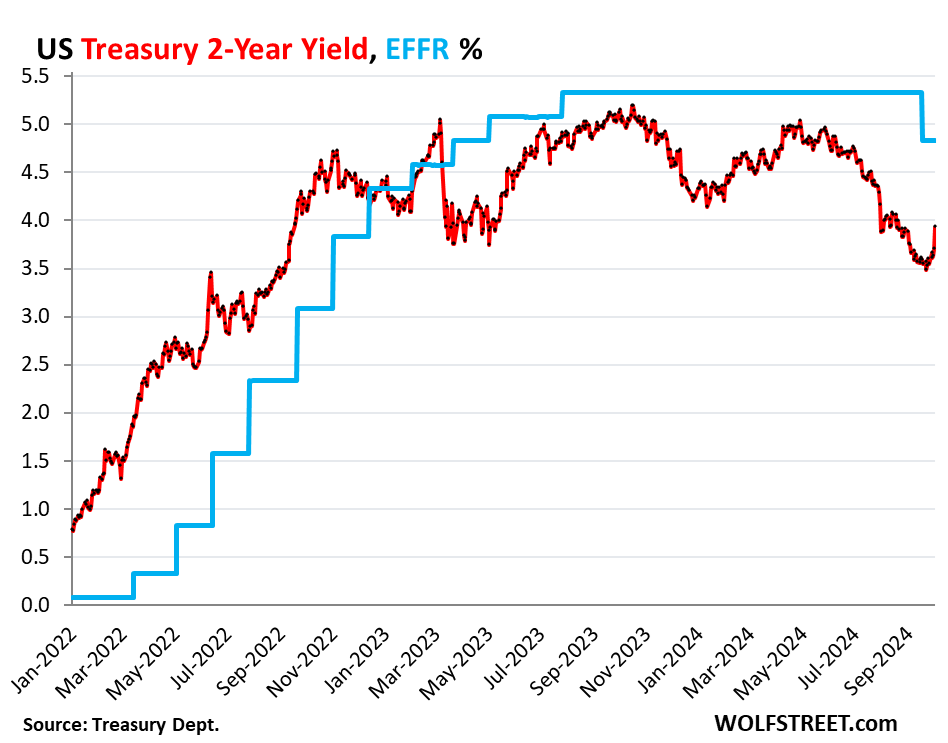

10 year yield it jumped 13 basis points on Friday and is up 33 basis points since the rate cut, to 3.98%. It is back where it was last on August 8th.

The 10-year rate is less indicative of rate cuts and rate cut expectations, which affect short-term yields, but is a greater indicator of inflation expectations over the next 10 years. And there are all kinds of forces going on right now that indicate that inflation may not be dormant again. We got the latest from the jobs report: strong increases in hourly wages in August and September.

After all, the 10-year yield is an indicator of expected supply, and because of the huge US debt, the supply is going to be huge, everyone knows that.

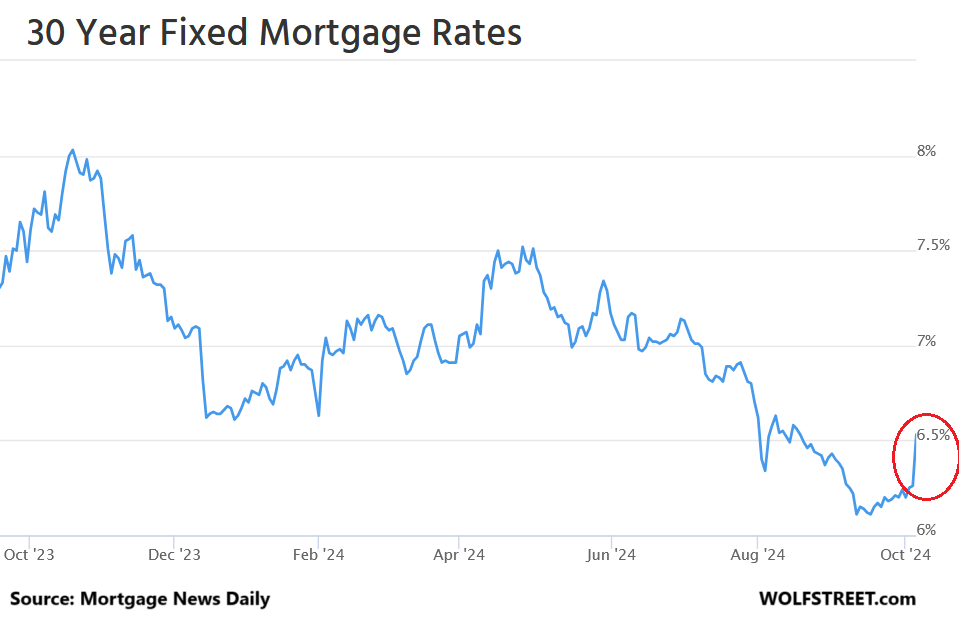

The average 30-year fixed rate mortgage has exploded on Friday by 27 points to 6.53%, according to Mortgage News Daily. It was a mess (chart by Mortgage News Daily).

Mortgage rates are roughly in line with the 10-year yield but at higher levels. The average between the 30-year rate and the 10-year yield has been 2.5 percent for the entire year, which is higher than the average over the past four decades, ranging from 0 percent to 4 percent. details.

With the 10-year yield at 3.98% on Friday, and the average 30-year fixed rate at 6.53%, the spread between the two measures was 2.55 percent.

The spread is likely to stay in this wide area because the Fed is no longer supporting the debt market, as it did during QE. As part of QT, it allows MBS to expire at the rate of principal payments, and lets its Treasury assets run at a rate of $25 billion per month. In September, the total assets of the Fed decreased by $ 66 billion, to $ 7.05 trillion.

The Fed has said that it will let MBS run fully even after QT expires, which would take years, and market participants will have to be lured in to replace the Fed, and this is I can say that the spread will be more spread over time. the QE era.

Despite the long drama, nothing happened in the short term.

Short-term yields are prices at a discount to the expected rate during their term. A security with 3 months left to run will sell for the best rate expectations in the next two months. As the security gets closer to its maturity date, lower policy rates are important because on the maturity date, the owner will be paid the face value plus interest. And that is the value of the protection on that day, regardless of what the policy rates are.

Price for 3 months rose 5 basis points on Friday, to 4.73%. But it has changed in this area for about two weeks. It is fully priced at one 25-basis-point cut, plus parts of a second 25-basis-point cut. The yield is down 22 basis points since September 17.

Enjoy reading WOLF STREET and want to support it? You can give. I really appreciate it. Click on the barrel of beer and iced tea to find out:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

![]()

#Mortgage #Rates #Explode #2Year #10Year #Treasuries #Raise #Confidence #Monster #RateCut #Hopes #Ended #Inflation #Fears #Continue #Yield #Curve #Cut