Here’s an Overview of Returning to the Document Market and Democratic and Republican Presidents in the White House | The Motley Fool

Did the stock market perform better when Democrats or Republicans controlled the White House?

The S&P 500 (^ GSPC 0.90%) It is one of the three major US financial sectors. It measures the performance of the 500 largest domestic companies covering approximately 80% of the domestic market by market value. Its size and diversity make it the best measure for the US stock market.

In 2024, the S&P 500 advanced more than 20% through the end of the third quarter, the strongest performance of the 21st century, according to JPMorgan Chase. That momentum is fueled by economic stability and excitement about artificial intelligence, as well as excitement about the Federal Reserve’s interest rate cuts.

However, the next presidential election is only one month away, and many investors are curious about the possible results. Read on to learn how the S&P 500 has fared with Democratic and Republican presidents in the White House.

Stock market averages are back under both Democratic and Republican presidents

Since its inception in 1957, the S&P 500 has increased 12,950% in value, compounding at 7.4% annually. This compound annual growth rate (CAGR) is based on the index’s stock return, meaning it does not account for dividend payments along the way. The total return, including installment payments, will be higher.

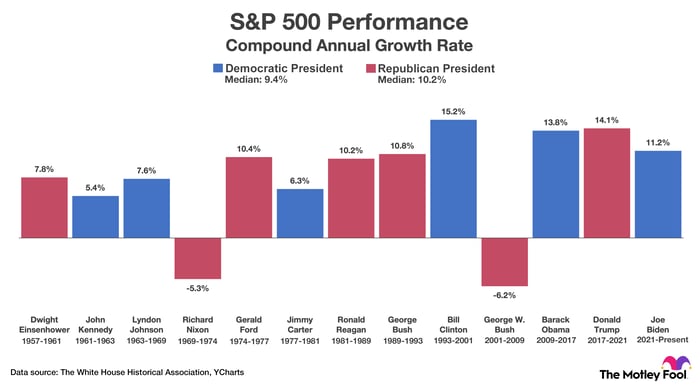

The chart below shows the CAGR of the S&P 500 during each presidency since the index’s inception. It also shows moderate CAGR under both Democratic and Republican presidents.

Data source: YCharts and White House Historical Association (inauguration days). Shown above is the annual growth rate of the S&P 500 during Democratic and Republican presidents.

As shown in the chart, the S&P 500 achieved an average CAGR of 10.2% under Republican presidents and 9.4% under Democratic presidents. In this sense, the American stock market has performed better during the period when the Republicans controlled the White House.

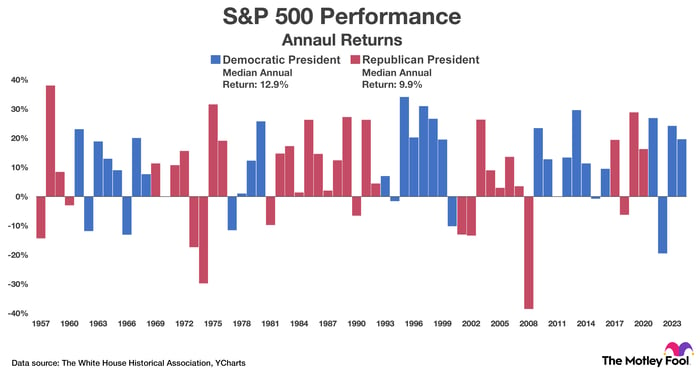

However, we can also look at the problem in a different way. In particular, instead of analyzing the CAGR during the entire presidency, we can analyze the return for each year. The chart below shows the return of the S&P 500 in each year since March 1957. It also shows the annual return when Democrats and Republicans held the presidency.

Data source: YCharts. Shown above is the annual return of the S&P 500 under Democratic and Republican presidents.

As shown above, the S&P 500 has achieved annual gains of 12.9% under Democratic presidents and 9.9% under Republican presidents. In this sense, the US stock market has done better when the Democrats have been in control of the White House.

Remember that presidents do not control the stock market or the economy. Their influence is limited to votes and budget proposals. For example, the president appoints seven members of the Federal Reserve Board of Governors, but those representatives must be confirmed by Senate lawmakers.

Additionally, Kamala Harris has proposed raising the corporate tax rate, and Donald Trump has proposed the opposite. Both changes can affect the stock market and the economy. However, Congress has the final say on budget proposals, and lawmakers are under no obligation to approve specific policies.

In addition, some events that influence the investment market and the economy cannot be controlled by any elected or appointed manager. Think of the dot-com bubble, the global financial crisis, and the COVID-19 pandemic. All those events affected the stock market and the economy, and no one could have prevented them.

History says that patient investors will be well rewarded regardless of who wins the presidential election.

There are two key takeaways for investors. First, statistics can be used to achieve the desired result. As noted, the stock market has performed better under Republicans in terms of median CAGR across all presidents, but it has performed better under Democrats in terms of median return over the years. Both statements are true, but they reach different conclusions.

Second, avoiding the stock market because one political party controls the White House would be a mistake. After reviewing returns since the 1950s, analysts are Goldman Sachs it concluded: “Investing in the S&P 500 only during Republican or Democratic presidencies would result in significant disadvantages versus investing in the index regardless of the political party in power.”

Here’s the bottom line: The S&P 500 has achieved a total return of 2,090% over the past 30 years, which equates to an annualized return of 10.8%. That period covers so many economic and market conditions that investors can expect similar returns for the next three decades. In that case, the US stock market is a smart place to invest regardless of which party wins the presidential election in November.

JPMorgan Chase is a marketing partner of The Ascent, a Motley Fool company. Trevor Jennewine has no position in any of the stocks mentioned. The Motley Fool ranks and recommends Goldman Sachs Group and JPMorgan Chase. The Motley Fool has a publicity strategy.

#Heres #Overview #Returning #Document #Market #Democratic #Republican #Presidents #White #House #Motley #Fool