After Siltronic AG’s (ETR:WAF) market cap plunged 81 million euros, institutional owners may have to take drastic action.

Important Notes

- Large Institutional investments in Siltronic means that they have a significant influence on the company’s share price.

- A total of 5 investors have majority stake in the company with 53% ownership.

- Proprietary research as well as analyst forecast data help provide a better understanding of the opportunities in the stock

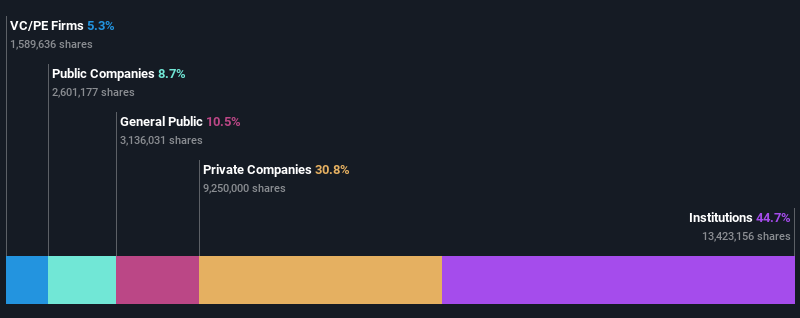

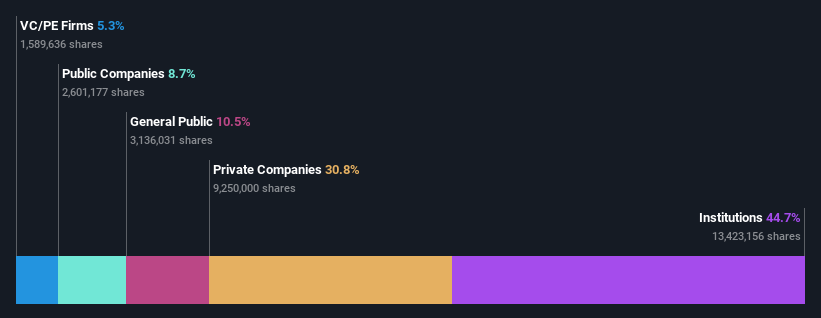

Every Siltronic AG (ETR:WAF) investor should know about the most powerful shareholder groups. At 45%, corporations own more shares than the company. That is, the group will benefit the most if the stock goes up (or lose the most if there is a drop).

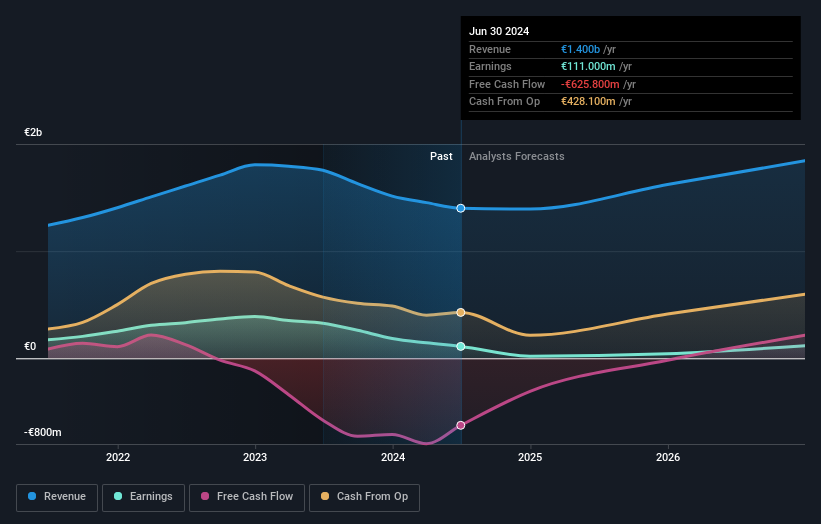

As a result, institutional investors suffered the highest losses last week after the market fell by €81m. The recent loss, which adds up to a one-year loss of 14% for stockholders, may not sit well with this group of investors. Often referred to as “market favors”, corporations have great power to influence the price force of any commodity.

Let’s take a closer look at each Siltronic owner model, starting with the chart below.

Get a full review of the Siltronic brand

What does the Institutional Ownership tell us about Siltronic?

Corporations often measure themselves on a valuation basis when they report to their investors, so they often have a lot of enthusiasm for a stock once it’s included in the main list. We would expect many companies to have other institutions in the register, especially as they grow.

As you can see, institutional investors have a fair share of Siltronic. This can show that the company has a certain degree of credibility in the investment community. However, it is better to be careful about relying on the evidence that is said to come with institutional investors. They, too, make mistakes sometimes. It is unusual to see a large drop in the share price if two institutional investors try to sell at the same time. So it is worth checking Siltronic’s past earnings, (below). Of course, remember that there are other factors to consider as well.

Hedge funds do not own many shares in Siltronic. The largest shareholder of the company is Dr. Alexander Wacker Familiengesellschaft mbH, who owns 31%. Meanwhile, the second and third largest shareholders, hold 8.7% and 5.3%, of the outstanding shares, respectively.

Our research also revealed the fact that almost 53% of the company is controlled by the top 5 owners which suggests that these owners have a great influence on the business.

Researching institutional ownership is a good way to measure and filter the expected performance of a stock. The same can be achieved by studying the opinions of critics. There are many analysts who deal with the stock, so it would be useful to get their general opinion about the future.

Inside Siltronic Owners

Although the correct definition of an insider can be important, almost everyone considers board members to be insiders. The management of the company runs the business, but the CEO will answer to the board, even if he is a member of it.

I generally consider insider ownership to be a good thing. However, sometimes it is difficult for others to hold the board accountable for decisions.

We note that our data does not reflect the board members who own the shares, per se. Not all jurisdictions have the same insider disclosure rules, and it’s possible we’ve missed something here. So you can click here to learn more about the CEO.

Public Authority in General

The general public, who are mostly individual investors, have a 10% stake in Siltronic. Although this majority of owners may not be enough to influence the policy decision in their favor, they can still have a collective influence on the company’s policies.

Human Rights Authority

With a 5.3% stake, private equity firms can influence Siltronic’s board. Some may like this, because private equity is sometimes the activist in charge of regulation. But sometimes, private equity is sold, taking the company public.

Ownership of a Private Company

Our data shows that private companies own 31% of the company’s shares. It would be good to look into this matter more deeply. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Public Company Authority

We can see that public companies hold 8.7% of Siltronic’s shares in the matter. It’s hard to tell the truth but this suggests that they have combined business interests. This may be an important part, so it is important to watch this site for personal changes.

Next Steps:

It is always important to consider the different groups that have a stake in the company. But to better understand Siltronic, we need to consider many other factors. Note that Siltronic shows 3 warning signs in our investment analysis and 1 of them should not be ignored…

If you prefer to find out what analysts are predicting about future growth, don’t miss this for free report on analysts’ estimates.

NB: The figures in this article are calculated using data for the last twelve months, which refers to the 12 month period ending on the last day of the month the financial statement is written. This may contradict the figures in the full year report.

New: Manage all your stock portfolios in one place

We made the ultimate portfolio partner for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Alerting of New Warning Signs or Hazards by email or phone

• Track the Quality of your goods

Try Demo Portfolio for free

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide opinions based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not cover recent releases that are not sensitive to pricing or quality materials. Simply Wall St has no position in the stocks mentioned.

#Siltronic #AGs #ETRWAF #market #cap #plunged #million #euros #institutional #owners #drastic #action